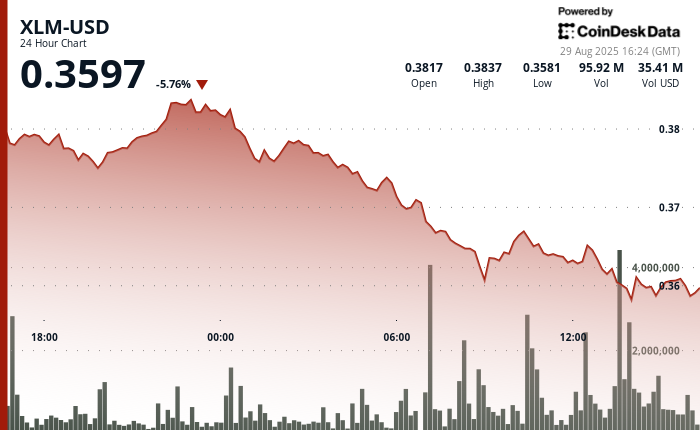

Stellar’s native token XLM came under heavy institutional selling pressure in the latest trading session, falling from $0.39 to $0.36 between August 28 at 3:00 p.m. and August 29 at 2:00 p.m. ET. Market data shows more than 41.89 million XLM changed hands, with volumes surging as large holders reduced exposure.

Despite the pressure, Stellar’s enterprise push remains intact. The Stellar Development Foundation reported the network is approaching 10 million registered accounts, boosted by daily growth of 5,000–6,000 new corporate wallets. Strategic partnerships with MoneyGram International and Circle Internet Financial continue to drive adoption of Stellar’s payment rails in cross-border finance.

Analysts highlighted sharp intraday swings on August 29, when XLM dropped 1.38% between 1:26 p.m. and 2:06 p.m., before institutional buyers reentered the market. The token recovered 1.27% during the 15-minute window that followed, closing the session at $0.361 after briefly touching $0.357.

A spokesperson close to Stellar’s corporate strategy stressed that the market turbulence was sentiment-driven rather than a reflection of business fundamentals. The late-session bounce suggested some large buyers viewed the decline as a buying opportunity, underscoring confidence in Stellar’s long-term role in blockchain-based financial infrastructure.

Technical Market Indicators Signal Mixed Corporate Sentiment

- XLM posted a 7.74% decline from $0.39 to $0.36 during the August 28-29 trading period.

- Daily trading range reached $0.031 between session high of $0.387 and low of $0.356.

- Peak selling activity occurred during morning European trading hours on August 29 with volume exceeding the 24-hour average of 41.89 million units.

- Technical resistance established near $0.373 level as institutional buyers remained cautious.

- Support levels identified at $0.375 and $0.362, with the lower threshold showing stability during final trading hours.

- Elevated trading volume during the decline indicates potential institutional accumulation strategies.

- Intraday price range of $0.005 during the final 60-minute trading period demonstrates continued market interest.

- Support at $0.357 attracted institutional buying interest before session close.

- Final hour recovery of 1.27% on volume exceeding 2 million units suggests corporate treasury departments may be accumulating positions.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.