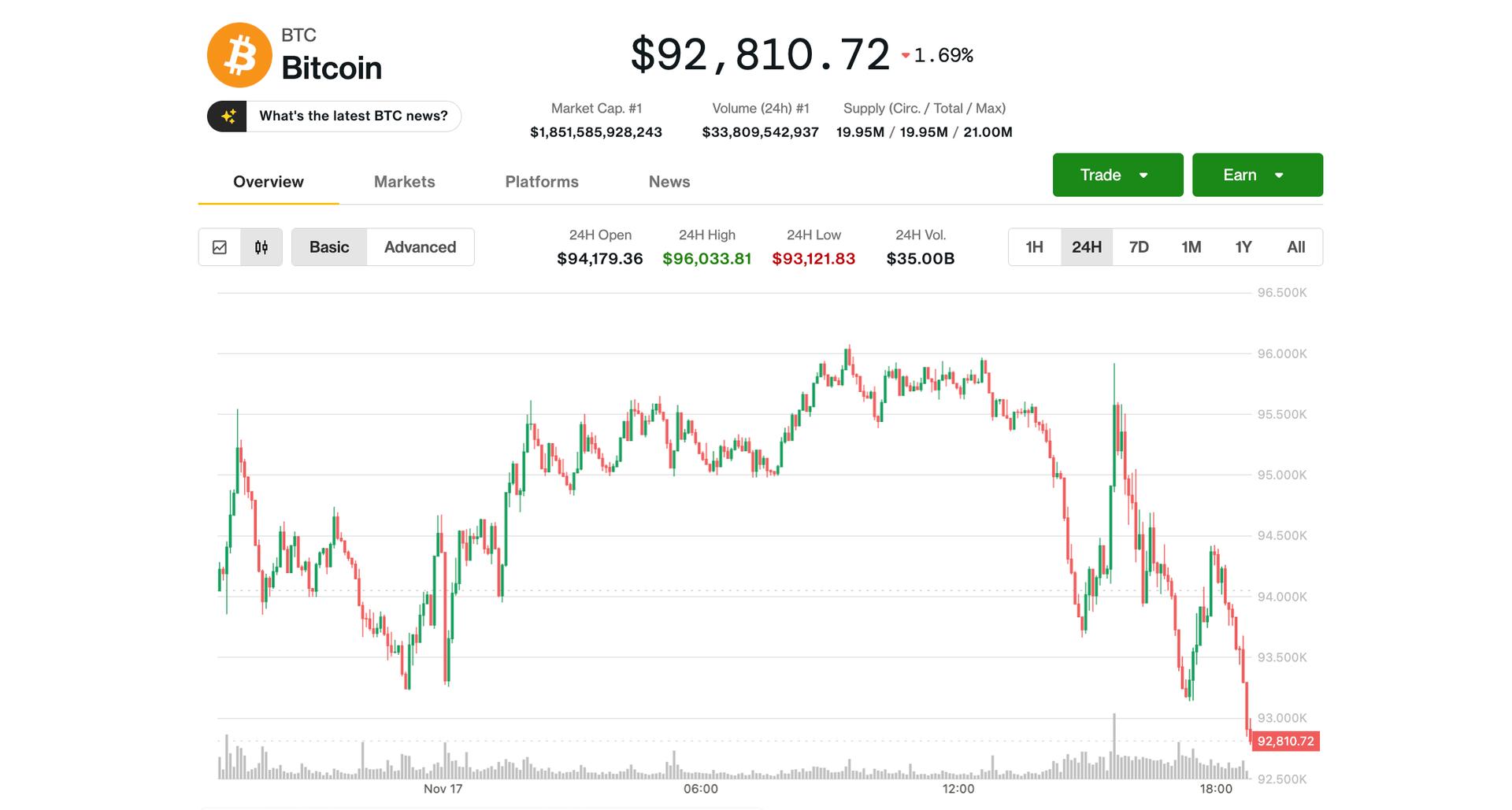

Bitcoin slumped to a fresh six-month low on Monday, extending its multi-week retreat as crypto sentiment continued to deteriorate.

After a slight rebound from overnight lows, BTC — in what’s become a familiar pattern — resumed its decline in the U.S. session, falling to $92,500, down 2.4% through the past 24 hours and nearly 13% over the past week. The largest crypto now has erased all its 2025 gains and declined 27% from its record high a little more than a month ago. Ether hovered above $3,000, off 2% in the past 24 hours and 15% over the past week.

The bearish sentiment spilled into crypto-related equities with Coinbase (COIN), Circle (CRCL), Gemini (GEMI) and Galaxy (GLXY) tumbling around 7%. Digital asset treasury-linked companies continued their descent: Strategy (MSTR), the largest corporate bitcoin holder, slid 4% to its lowest since October 2024, while ether treasury firms BitMine (BMNR), ETHZilla fell 8% and 14%, respectively. Solana-linked Upexi (UPXI) and Solana Company (HSDT) dropped 10% and 7%, respectively.

Bitcoin miners tied to high-performance computing and AI infrastructure fared better after weeks of drawdowns. Hive Digital (HIVE) jumped 10% on news its HPC subsidiary struck an AI cloud partnership with Dell Technologies. IREN (IREN) and Hut 8 (HUT) also posted modest gains.

Diminishing chance for Fed rate cut

Thanks to the government shutdown, there hasn’t been much in the way of official economic statistics for weeks, making otherwise little-followed reports grow in importance.

To wit, this morning’s New York Federal Reserve’s Empire State Manufacturing Survey. That gauge unexpectedly jumped eight points to 18.7, far above analyst forecasts for a decline to 6. The upside surprise is likely to add to the growing case for the Fed to hold interest rates steady at its next meeting in December, rather than cut, as previously expected by markets.

Polymarket traders are now assigning a 55% odds that the federal funds rate will remain unchanged at the December meeting, while the CME FedWatch Tool places the probability of pausing slightly higher at around 60%.

CoinDesk Senior Analyst James Van Straten also pointed to a technical headwind. Bitcoin futures on the Chicago Mercantile Exchange (CME) opened at $93,840 on Sunday, leaving a gap to $91,970 from April still unfilled — a level that may attract short-term downward pressure, as bitcoin frequently revisits such gaps, he noted.

Meanwhile, Bitfinex analysts noted that the pace of realized losses is starting to stabilize, suggesting bitcoin could be approaching a local low for at least for a rebound.

“Across multiple historical cycles, sustainable bottoms have only formed after short-term holders have capitulated into losses and not before,” the analysts said in a note shared with CoinDesk. “The market appears to be approaching that threshold once again, with near-term resilience contingent on whether this capitulation phase can exhaust remaining sell-side pressure.”

They added that this is now the third-largest pullback since 2023, and second-largest since the U.S. spot bitcoin ETFs launched, arguing that a local bottom could form “relatively soon.”

Read more: Bitcoin Accumulation Amid Market Weakness? Sharp Rise in 1K BTC Holders Suggests So