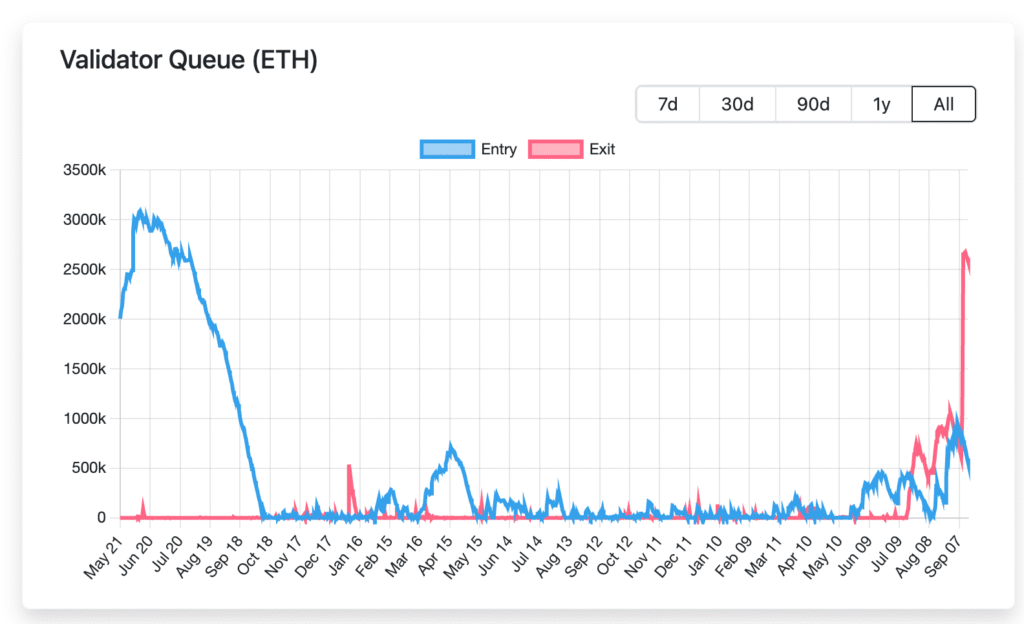

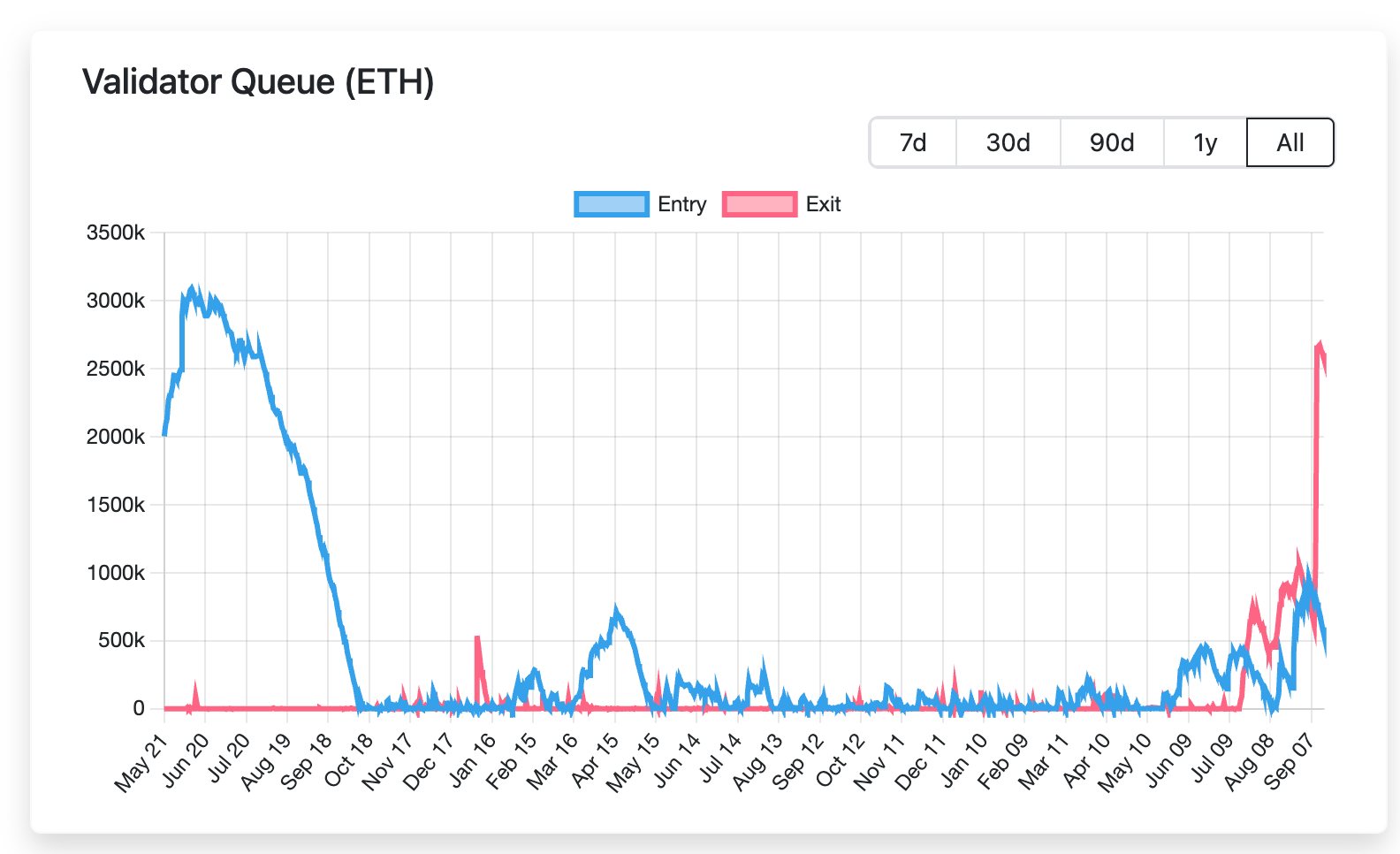

Ethereum’s proof-of-stake system is facing its largest test yet. As of mid-September, roughly 2.5 million ETH — valued at roughly $11.25 billion — is waiting to leave the validator set, according to validator queue dashboards.

The backlog pushed exit wait times to more than 46 days on Monday, the longest in Ethereum’s short staking history, dashboards show. The last peak, in August, put the exit queue at 18 days.

The initial spark came on Sept. 9, when Kiln, a large infrastructure provider, chose to exit all of its validators as a safety precaution. The move, triggered by recent security incidents including the NPM supply-chain attack and the SwissBorg breach, pushed around 1.6 million ETH into the queue at once. Though unrelated to Ethereum’s staking protocol itself, the hacks rattled confidence enough for Kiln to hit pause, highlighting how events in the broader crypto ecosystem can cascade into Ethereum’s validator dynamics.

In a blog post from staking provider Figment, Senior Analyst Benjamin Thalman noted that the current exit queue build up isn’t only about security. After ETH has rallied more than 160% since April, some stakers are simply taking profits. Others, especially institutional players, are shifting their portfolios exposure.

At the same time, validators entering the Ethereum staking ecosystem have been steadily rising. The SEC’s May statement clarifying that staking is not a security has renewed interests in staking. Anticipation of ETH ETF approvals is another driver, as funds prepare for regulated ways to capture staking yield, Thalman noted.

Ethereum’s churn limit, which is a protocol safeguard that caps how many validators can enter or exit over a certain time period, is currently capped at 256 ETH per epoch (about 6.4 minutes), restricting how quickly validators can join or leave the network, and is meant to keep the network stable.

With more than 2.5M ETH lined up, stakers on Wednesday face 44 days before even reaching the cooldown step.

Thalman believes that much of the ETH existing will simply be restaked under new validators, meaning that if even 75% of the current queue is re-deposited, nearly 2 million ETH will flood the activation queue, bringing delays for new ETH staking, and a backlog on both sides of the validator queue.

“The activation queue is currently 13 days, to this add the ~2M ETH from those currently exiting (35 days) and 4.7M from ETFs (81 days), and the total is 129 days. This assumes that there are no other ETH holders that choose to stake and enter the queue, like corporate treasuries,” Thalman wrote in the blog.

The swelling queue underscores a paradox: Ethereum is working “as intended” Thalman notes, and the demand to both exit and re-enter highlights staking’s central role in the ecosystem. The network is thus experiencing the growing pains of a maturing, institutionalized system where infrastructure scares, profit cycles, and regulatory shifts all collide in real time.

Read more: Ethereum Staking Queue Overtakes Exits as Fears of a Sell-off Subside