Many investors are currently viewing bitcoin through an end-of-cycle lens, suggesting that Q4 could mark the close of the current market cycle. However, two key metrics point to the possibility that the bull market may actually be in its early stages.

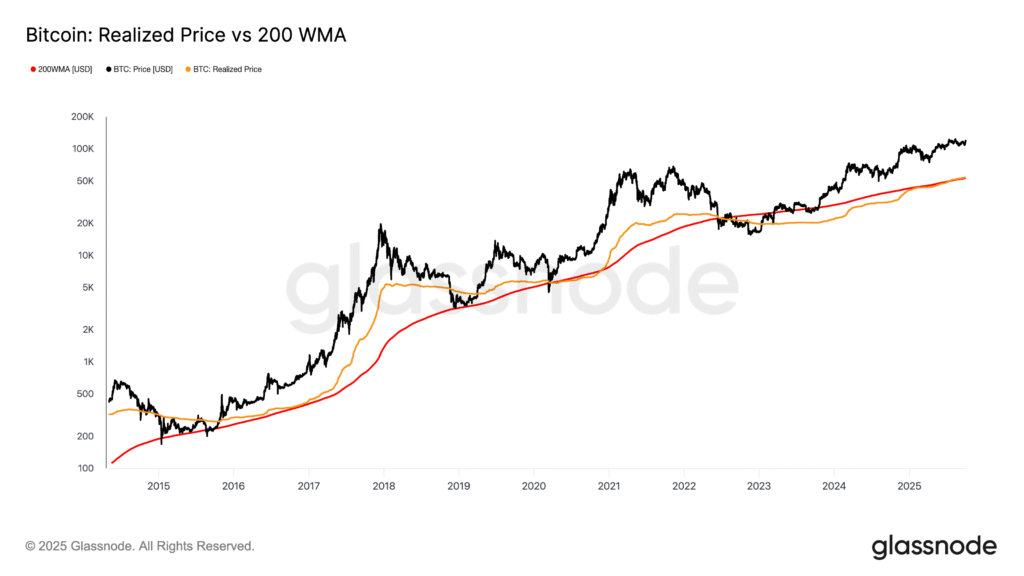

Glassnode data shows that the 200-week moving average (200WMA), which smooths bitcoin’s price over a long-term horizon and has historically only trended upwards, has just breached $53,000.

Meanwhile, the realized price, the average price at which all bitcoin in circulation last moved onchain, has just risen above the 200-WMA at $54,000.

Looking back at previous cycles, we see a consistent pattern. In bull markets, the realized price tends to stay above the 200-WMA, while in bear markets, the opposite occurs.

For example, in the 2017 and 2021 bull markets, the realized price steadily climbed higher and widened its gap above the 200-WMA, before eventually collapsing below it and signaling the start of the bear markets.

While, during the downturn of 2022, the realized price fell below the 200-WMA, it has only recently moved above it. Historically, once the realized price remains above this long-term moving average, bitcoin has tended to push higher as the bull market progresses.