Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

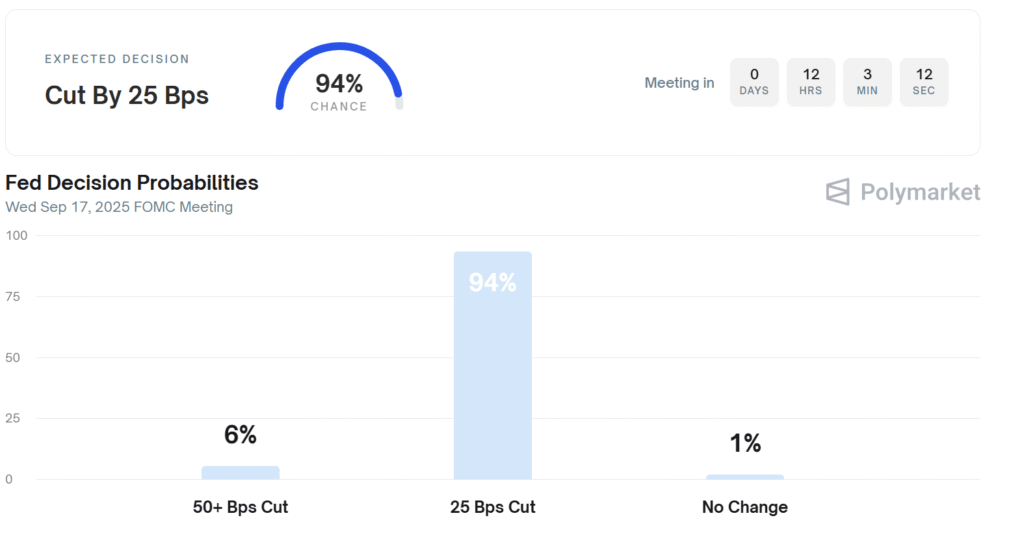

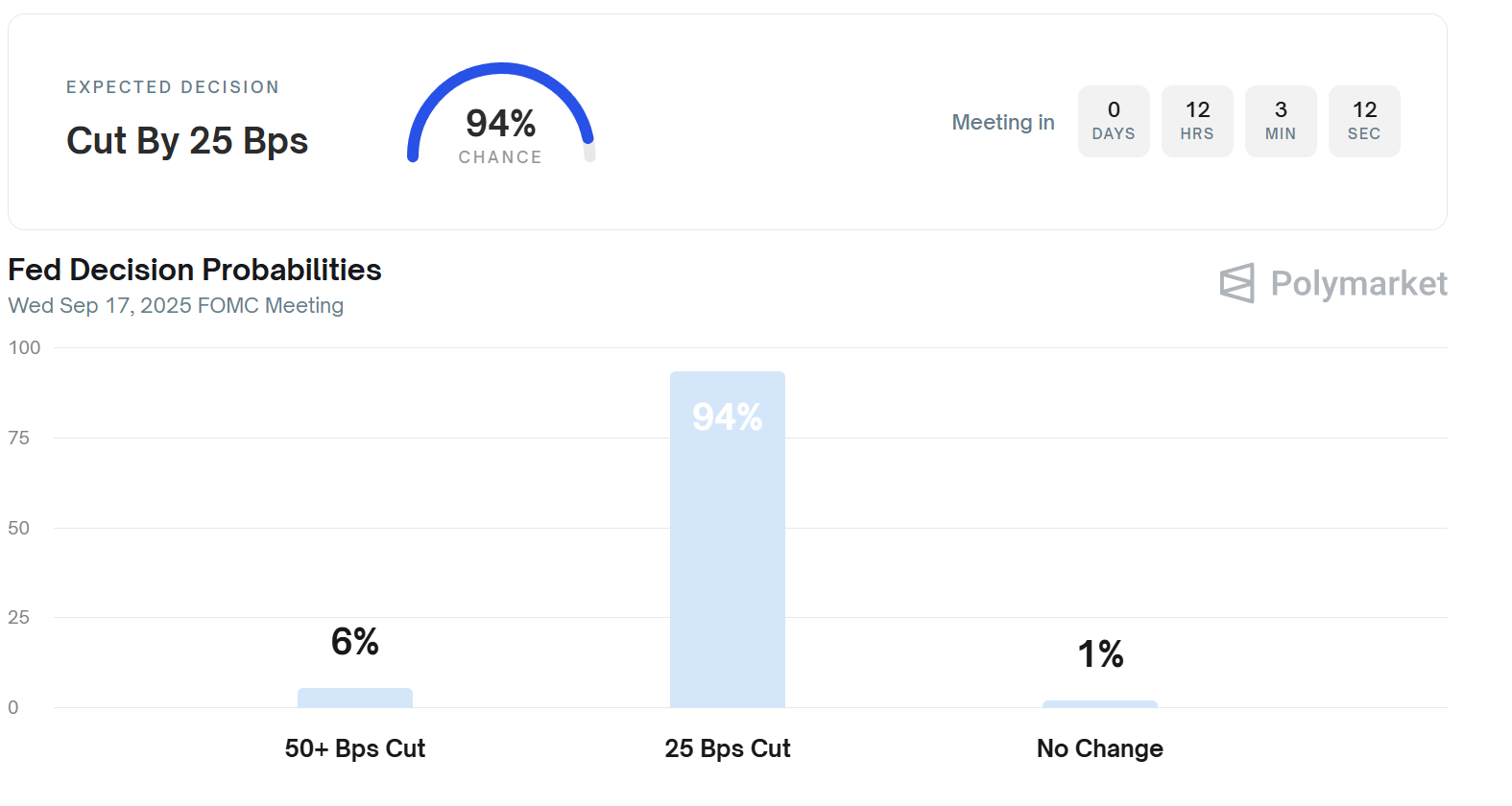

Polymarket and CME FedWatch are aligned: the Fed’s easing cycle begins tomorrow. Both have a 25 bps cut locked in for the next FOMC meeting, with odds building for a three-cut path through year-end.

Polymarket traders leave more room for aggressive easing, while CME assigns steadier probabilities of 25 bps steps. Either way, markets see 75 bps in cuts as the baseline for 2025.

Market conviction around the Fed pivot is already showing up on-chain, with BTC trading at $116,762, up 1.3% on the day and 4.7% on the week, while ETH sits at $4,502, up 4.3% on the week as traders price in the cuts.

Now, some traders are sitting on the sidelines to see just how the market might react as the Fed announces cuts.

In a recent report, CryptoQuant data shows bitcoin exchange inflows have dropped to a 7-day average of just 25,000 BTC, the lowest in more than a year and a half; the level seen in mid-July when BTC first crossed $120,000. The average BTC deposit size has also halved to 0.57 BTC, evidence that large holders are sitting idle rather than rushing to sell.

ETH is seeing the same pattern: exchange inflows have fallen to a two-month low of 783,000 ETH, down sharply from 1.8 million in August. The average ETH deposit has declined to 30 ETH from 40–45 ETH earlier this summer, suggesting reduced sell-side activity from whales.

If BTC and ETH are being hoarded, stablecoins are flowing in CryptoQuant writes in its report. USDT deposits into exchanges surged to $379 million at the end of August, the highest this year, and remain elevated at $200 million. The average daily USDT deposit has doubled since July, giving exchanges the “dry powder” needed to support a post-Fed rally.

But the flows aren’t uniform. Altcoins are seeing a resurgence of exchange activity, with transaction deposits climbing to a 7-day total of 55,000, up from a flat 20,000–30,000 range earlier this year. That divergence signals possible profit-taking in higher-beta names even as BTC and ETH supply remains tight.

“September brings a wave of token unlocks totaling $4.5 billion, a dynamic that could pressure liquidity and test market absorption,” OKX Singapore CEO Gracie Lin wrote in a note to CoinDesk.

True opportunity lies beyond short-term volatility, Lin argued.

“Stablecoins are nearing $300 billion in supply, token unlocks are putting market depth to the test, and major infrastructure upgrades like Nasdaq’s move toward tokenized securities are signaling that crypto is becoming part of the global financial system, not an outlier,” she wrote.

The message is clear: the Fed pivot is nearly priced in. What matters now is whether crypto’s liquidity buffers, stablecoins, exchange inflows, and token unlocks can absorb the shocks and channel capital into the next leg higher for BTC.

Market Movement

BTC: BTC is trading above $116,500 as traders are optimistic about potential U.S. interest rate cuts. Technical factors such as the closing of futures gaps have added upward pressure. Some caution is setting in ahead of the Fed meeting.

ETH: ETH is trading with modest strength, supported by overall crypto market momentum (dominated by BTC), but with some resistance as investors weigh macro risks and await clarity on policy from the Fed.

Gold: Gold is hitting record highs, driven by expectations that the U.S. Federal Reserve will cut rates, a weakening U.S. dollar, and heightened geopolitical or macroeconomic uncertainty. Safe‑haven demand from investors is strong.

Nikkei 225: Asia-Pacific stocks fell on Wednesday morning, with Japan’s Nikkei 225 down 0.3%, as investors tracked Wall Street losses and awaited a likely Fed rate cut decision.

S&P 500: The S&P 500 slipped 0.13% to 6,606.76 Tuesday as investors booked profits ahead of the Fed’s rate decision after touching a record high earlier.

Elsewhere in Crypto

- Eric Trump defends UAE-Binance deal, says his father is ‘first guy who hasn’t made money off of the presidency’ (The Block)

- President Trump Alleges New York Times Harmed Meme Coin in $15 Billion Lawsuit (Decrypt)

- The Clarity Act Is Probably Dead: Here's What's Next for Its Successor Legislation (CoinDesk)