XRP slipped to $1.86 as traders continued to sell into rallies, even as spot ETF demand stayed steady and total ETF-held assets climbed to $1.25 billion — a gap that suggests the market is still digesting supply at key technical levels.

News background

Institutional appetite for XRP exposure continued to build through exchange-traded funds, with investors adding $8.19 million in recent sessions. That pushed total ETF-held net assets to $1.25 billion, reinforcing the idea that professional investors are building positions through regulated vehicles rather than chasing spot momentum.

The flow trend fits a broader pattern in institutional crypto allocation: portfolio managers increasingly prefer structured products that reduce custody and compliance friction, especially when liquidity is deep and regulatory clarity is improving. XRP’s depth across venues and the steady ETF bid has kept longer-term demand intact, even as short-term price action remains choppy.

In the wider market, bitcoin’s attempted rebound lacked follow-through during U.S. hours, leaving majors stuck in a risk-off, range-bound tape where flows matter but technical levels still dictate the day-to-day trade.

Technical analysis

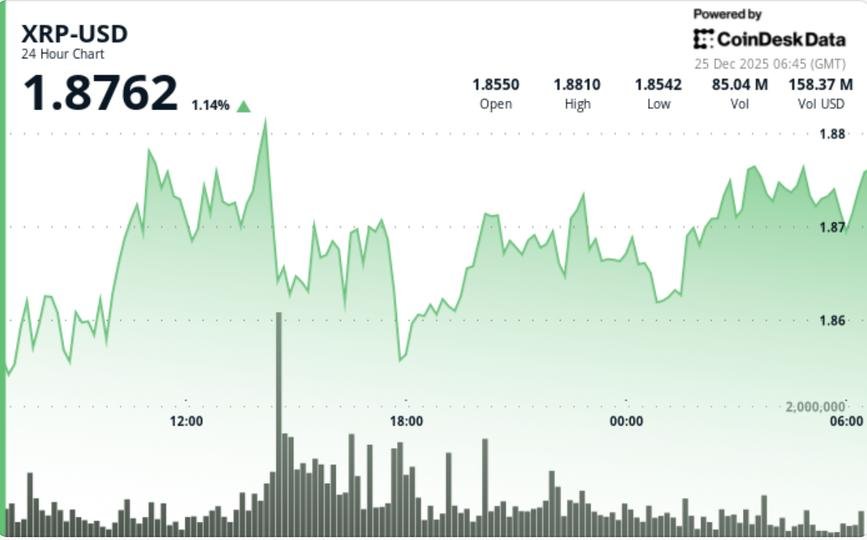

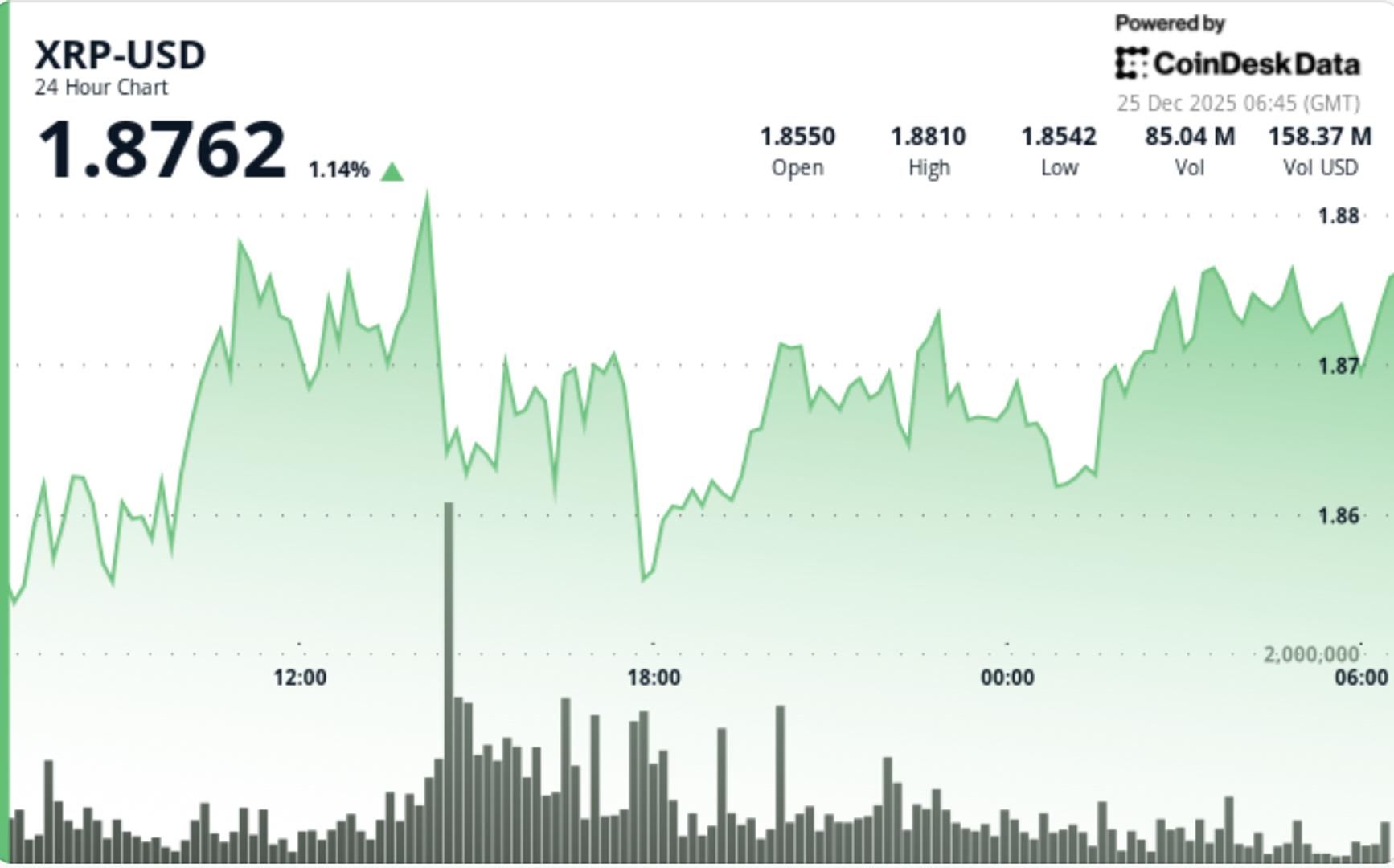

XRP fell from $1.88 to $1.86, staying pinned inside a $1.85–$1.91 channel as sellers repeatedly defended the $1.9060–$1.9100 resistance area. Volume rose sharply during the session’s most active window, with 75.3 million changing hands — about 76% above average — during the rejection, underscoring that this isn’t a low-liquidity drift. It’s a market meeting real offers overhead.

Price briefly pushed out of its $1.854–$1.858 consolidation pocket and tested $1.862 on a burst of activity that spiked roughly 8–9x versus typical intraday flow. But the move lacked persistence, and XRP rotated back toward $1.86 as supply returned.

The repeated defense of $1.90+ suggests sellers are still using that zone to distribute into strength. At the same time, bids near $1.86–$1.87 have shown up consistently enough to keep the market from unraveling — creating a tightening coil where the next break is likely to be decisive.

Price action summary

- XRP slid from $1.8783 to $1.8604, staying locked in a $1.85–$1.91 range

- The strongest selling response arrived near $1.9061 resistance on above-average volume

- Bulls held the $1.86 handle on multiple retests, limiting downside follow-through

- A short-lived pop above the prior consolidation pocket failed to turn into a sustained move

What traders should know

Two forces are competing, and that’s the story: ETF flows keep leaning supportive in the background, but near-term traders are still treating $1.90–$1.91 as a sell zone.

The levels are clean:

- If $1.87 holds and XRP can reclaim $1.875–$1.88, the next test is the heavy supply cluster at $1.90–$1.91. A close above there would force short-covering and pull price toward $1.95–$2.00.

- If $1.86 fails, the market likely slides into the next demand pocket around $1.77–$1.80, where prior buyers have historically defended and where “fear” sentiment tends to peak.

For now, the tape reads like consolidation with distribution overhead — but with ETF flows acting as a stabilizer that could make downside moves more grinding than free-falling unless bitcoin breaks down sharply again.