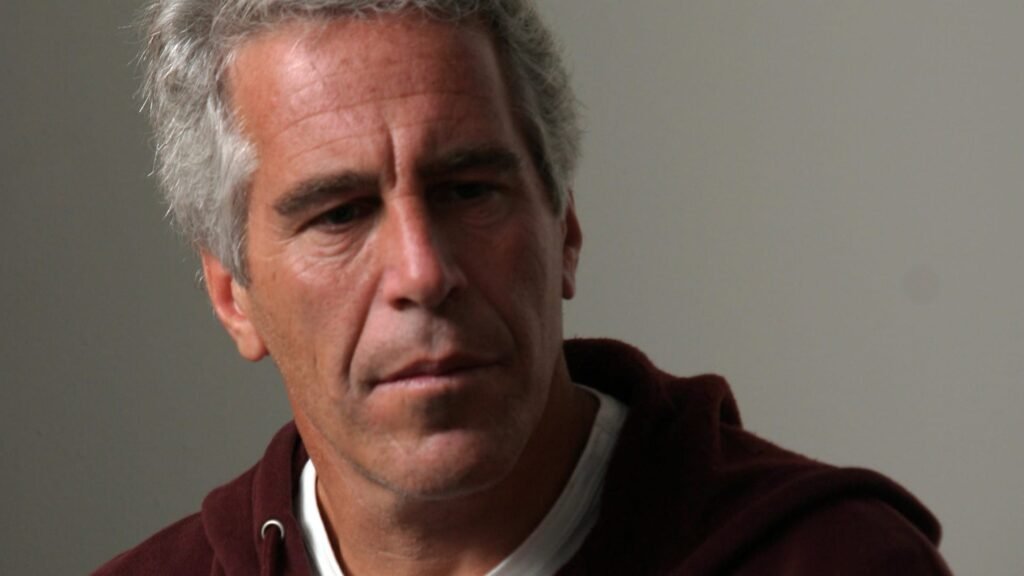

Jeffrey Epstein in 2004.

Rick Friedman | Corbis News | Getty Images

A top House Democrat asked four major bank CEOs to share a slew of financial records related to Jeffrey Epstein, pushing forward an investigation into the notorious sex predator, after the lawmaker’s effort to subpoena the banks for the documents was blocked by Republicans.

House Judiciary Committee ranking member Jamie Raskin, D-Md., in letters to the CEOs obtained by CNBC, asked how Epstein and his co-conspirators could have conducted a reported $1.5 billion in suspicious transactions “for years without ever being caught.”

The letters were sent on Wednesday to JPMorgan Chase CEO Jamie Dimon, Bank of America chief Brian Moynihan, Deutsche Bank leader Christian Sewing and Bank of New York Mellon CEO Robin Vince.

Download Raskin’s letters to Dimon, Moynihan, Sewing and Vince.

The letters came as the Trump administration continues to face pressure — from Democrats and from some of President Donald Trump’s Republican supporters — over its handling of matters related to Epstein.

The wealthy financier and sex offender, who was once a friend of Trump’s, died by suicide while in jail facing federal child sex trafficking charges in 2019.

In his letters, Raskin bluntly asked each CEO if their bank will “help reveal the truth” about Epstein and his co-conspirators, or if they would “choose to be part of the cover-up for this massive, international sex trafficking ring that victimized more than 1,000 women and girls?”

Deutsche Bank, in a statement to CNBC, said that it “takes its legal obligations seriously, including appropriately responding to authorized investigations and proceedings.” The statement did not explicitly commit to complying with Raskin’s requests.

“The bank regrets our historical connection with Jeffrey Epstein,” Deutsche Bank said. “We have cooperated with regulatory and law enforcement agencies regarding their investigations and have been transparent in addressing deficiencies and investing in strengthening our control environment in parallel.”

JPMorgan declined to comment on Raskin’s request.

The congressman, in his letter to Dimon, emphasized that the CEO recently said, referring to Epstein, that he and JPMorgan “regret any association with that man at all.”

Raskin also noted that Dimon had committed to providing information to the Judiciary Committee.

But Dimon had specified that he would comply with a subpoena, saying, “If it’s a legal requirement, we would conform to it. We have no issue with that.”

JPMorgan and Deutsche Bank have both paid substantial sums to settle lawsuits accusing them of facilitating and financially benefiting from sex trafficking by their client, Epstein.

In 2023, JPMorgan agreed to pay $290 million to settle a class-action lawsuit on behalf of Epstein victims and reached a $75 million settlement in a separate case brought by the U.S. Virgin Islands.

The same year, Deutsche Bank agreed to pay $75 million to Epstein victims to settle a suit.

Bank of America and BNY Mellon did not respond to CNBC’s requests for comment on Raskin’s letters to their CEOs.

Raskin wrote that he was sending the letters after Republicans, who hold a majority on the Judiciary panel voted against Democratic members’ attempt to issue subpoenas to the four bank CEOs last month.

The subpoena effort fell in a nearly party-line vote. Rep. Thomas Massie of Kentucky was the only Republican to vote in favor of the subpoenas.

The request for subpoenas came at the end of a hearing with FBI Director Kash Patel, whom Democrats grilled about the Trump administration’s handling of the so-called Epstein files.

Raskin, in his letters, asserted that Patel’s testimony showed that his FBI “has failed to ‘follow the money'” regarding suspicious transactions related to Epstein that the banks had reported to the Treasury Department.

Raskin’s letters focused on records known as Suspicious Activity Reports, SARs, which banks are required to file when they notice certain unusual financial activities that may be connected to illegal conduct.

The lawmaker accused each of the four banks of either ignoring or failing to adequately report red flags about Epstein’s financial transfers.

Deutsche Bank, for instance, “witnessed but failed to report a stream of red flags relating to Mr. Epstein, including his attorneys sending millions of dollars to women with Eastern European surnames,” Raskin told Sewing.

JPMorgan “did not file a single SAR” until after Epstein’s death, “despite the flagrant nature” of his activities, Raskin wrote to Dimon.

Bank of America appears to have filed just two “significantly delayed” SARs about “$170 million in transactions between Mr. Epstein and billionaire investor Leon Black,” the lawmaker told Moynihan.

BNY Mellon reportedly filed SARs linked to $378 million in Epstein-related payments only “years after Mr. Epstein’s death,” Raskin wrote to Vince.

Raskin’s letters cited findings from an investigation being led by Senate Finance Committee ranking member Ron Wyden, D-Ore., who says that bank records held by the Treasury Department show Epstein-related transactions totaling at least $1.5 billion.

House Oversight Committee Chairman James Comer, R-Ky., who is leading his own probe of Epstein’s money trail, in mid-September said that the Treasury Department pledged to share documents with his panel.

Raskin wants the banks to provide all information about any transaction relating to Epstein, his convicted accomplice, Ghislaine Maxwell, or their victims that had been identified for “further review, inspection, or discussion.”

He also asked for all internal communications and discussions with federal authorities about Epstein, as well as any risk assessments and due diligence reports that the banks may have created.

The requests cover records spanning from 1998 to the present day. Raskin asked them to deliver the materials to his committee by 5 p.m. ET on Oct. 22.

Raskin appealed to the banks’ reputations in his letters.

“If you truly regret JPMorgan’s shameful association with Mr. Epstein, we trust that you will work with us to promptly produce these records and help us ensure that neither your bank nor any other American bank ever again enables and bankrolls a criminal sex trafficking ring like Mr. Epstein’s,” he wrote to Dimon.

— CNBC’s Hugh Son contributed to this report.