Stablecoin giants like Tether and Circle are profiting from the current high-interest rate environment while stablecoin holders see none of the returns, said Wormhole’s co-founder, Dan Reecer, at Mercado Bitcoin’s DAC 2025 event.

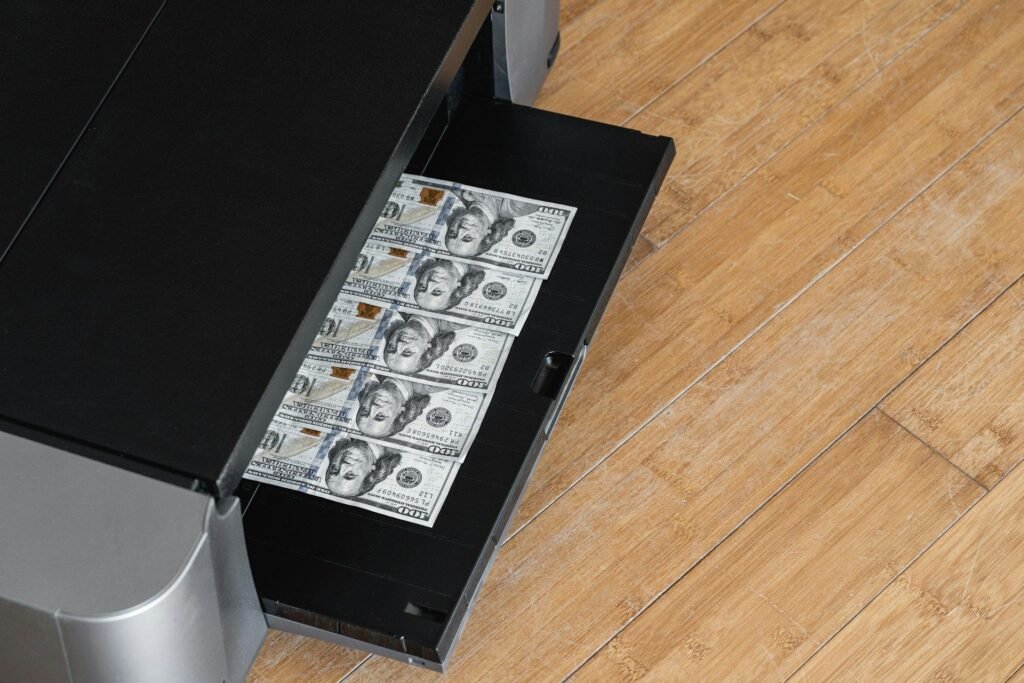

Speaking as a panelist, he said the companies are effectively “printing money” by keeping the yield from the U.S. Treasuries backing their tokens. Tether, for example, reported $4.9 billion in net profit in the second quarter of the year. That has seen the company’s valuation soar to a reported $500 billion in a new funding round.

As interest rates remain elevated, Reecer suggested it’s only a matter of time before users expect a share of that yield or move their funds elsewhere.

Platforms like M^0 and Agora are already responding to that demand, he suggested. These projects allow stablecoin infrastructure to be built in a way that routes yield to applications or directly to end users, instead of the issuer capturing all of it.

“If I’m holding USDC, I’m losing money, losing money that Circle is making,” Reecer said in the session, referring to the opportunity cost of holding a non-yielding token that’s backed by U.S. Treasuries generating income.

Tether and Circle likely do not share the yield generated from their stablecoins directly with users as doing so could draw the ire of regulators. An alternative that’s steadily growing are money market funds, which allow investors to gain exposure to the yield behind these stablecoins.

Circle, it’s worth noting, acquired Hashnote earlier this year for $1.3 billion, the issuer of the tokenized money market fund USYC. With this acquisition, Circle aims to enable convertibility between cash and yield-bearing collateral on blockchains.

These money market funds, however, are still a fraction of the stablecoin market. According to RWA.xyz data, their market capitalization currently stands around $7.3 billion, while the global stablecoin market has topped $290 billion.

A Tether spokesperson told CoinDesk that “USDT’s role is clear: it is a digital dollar, not an investment product.” He added that “hundreds of millions of people” rely on USDT, especially in emerging markets, “where it serves as a lifeline against inflation, banking instability, and capital controls.”

“While few percentage points might make the difference for rich Americans or Europeans, the real savings for our USDT user base is the one against dramatic inflation so common in developing countries – often reaching numbers as high as 50% to 90% year-over-year, with declines of local currency values against the US dollar at 70% year-over-year,” he said.

“Passing along yield would fundamentally change a stablecoin’s nature, risk profile, and regulatory treatment,” the spokesperson added. “Competitors experimenting with yield-bearing stablecoins are targeting a completely different audience, and they take on additional risks.”

Fireblocks’ Stephen Richardson, during the panel, said the broader stablecoin market is meanwhile evolving toward real-world use cases, including cross-border payments and FX services.

He pointed out that tokenized money moving instantly could help solve problems that exist today, such as slow corporate payment rails or expensive remittances. Financial innovation, Richardson added, is already being seen in the sector, with an example being tokenized money market funds that are being used as collateral on exchanges.