Nearly all crypto assets are seeing red on Monday morning, with the total market capitalization for all crypto assets falling below $4 trillion since Sunday evening.

Bitcoin (BTC-USD) fell 3%. The second-largest cryptocurrency, ether (ETH-USD), fell 6%. Solana’s (SOL-USD) token is down 7%. Dogecoin (DOGE-USD) and World Liberty Financial (WLF) are each down 10%.

Over Sunday night, a total of $1.7 billion in trading positions in the crypto derivatives market were liquidated, according to data provider Coinglass.

Of those positions, 94% came from bullish trades with the single largest whip out — valued at $12.7 million — occurring on crypto exchange OKX.

Traders taking bullish bets on ether have seen over $500 million in liquidations while those gambling on bitcoin have seen $280 million taken out, according to Coinglass.

Crypto assets sold off last week following the Federal Reserve’s well-telegraphed signal that it would lower its short-term policy rate by a quarter of a percentage point.

Companies holding bitcoin and other digital assets — so-called crypto treasury companies — have faced pressure in recent weeks after seeing wild stock surges earlier this year.

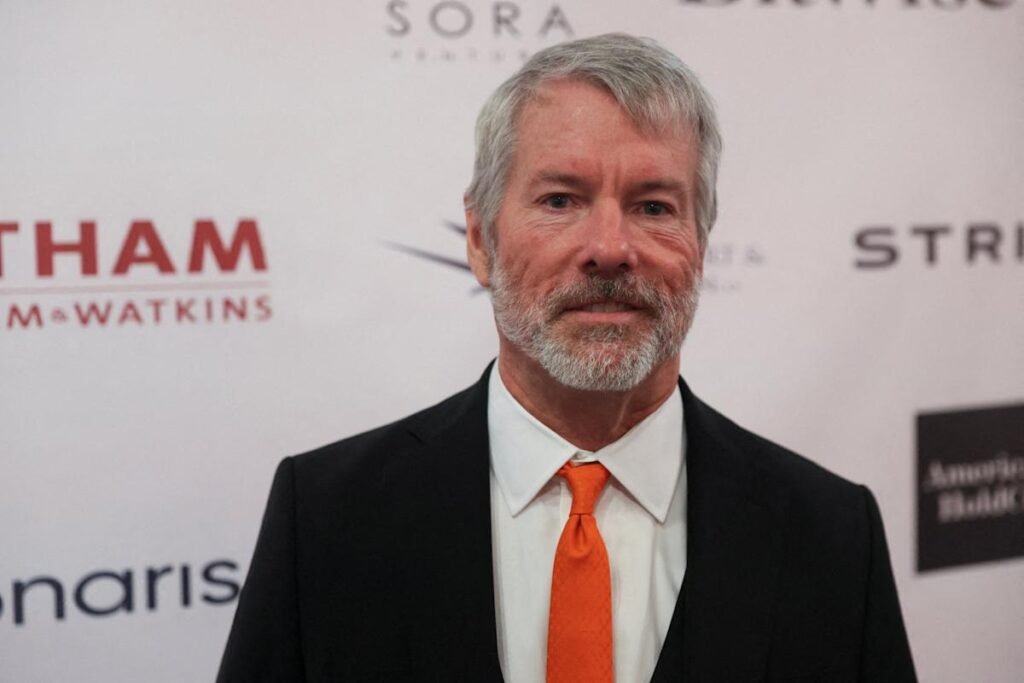

There are now more than 180 public companies that have added bitcoin to their balance sheets to date, according to data provider BitcoinTreasuries.net. Many have launched over the past year in order to replicate the outsized stock performance of Michael Saylor’s bitcoin giant Strategy (MSTR).

Strategy’s stock (MSTR) is down 1.3%. The company piled into a bet on bitcoin starting in 2020, using a combination of debt and equity to fund massive purchases of the cryptocurrency that turned the business intelligence software firm into a bitcoin juggernaut. Despite lagging recently, the stock has seen a surge of 2,200% since it first started buying bitcoin.

Of those firms, some 94 are considered imitators of Strategy based on their size, business model, and how they fund their bitcoin purchases, according to Vetle Lunde, head of research for Oslo, Norway-based crypto market research firm K33.

Roughly 25% have market capitalizations that have sagged below the value of their bitcoin holdings, according to K33 Research.

The dynamic prompted the first merger within the bitcoin treasury space.

On Monday, the stock of health tech firm turned bitcoin treasury company Semler Scientific (SMLR) rose 27% following the announcement that it had reached an agreement to be acquired by a larger bitcoin treasury company, the Vivek Ramaswamy-backed Strive Inc. (ASST) through an all-stock merger.