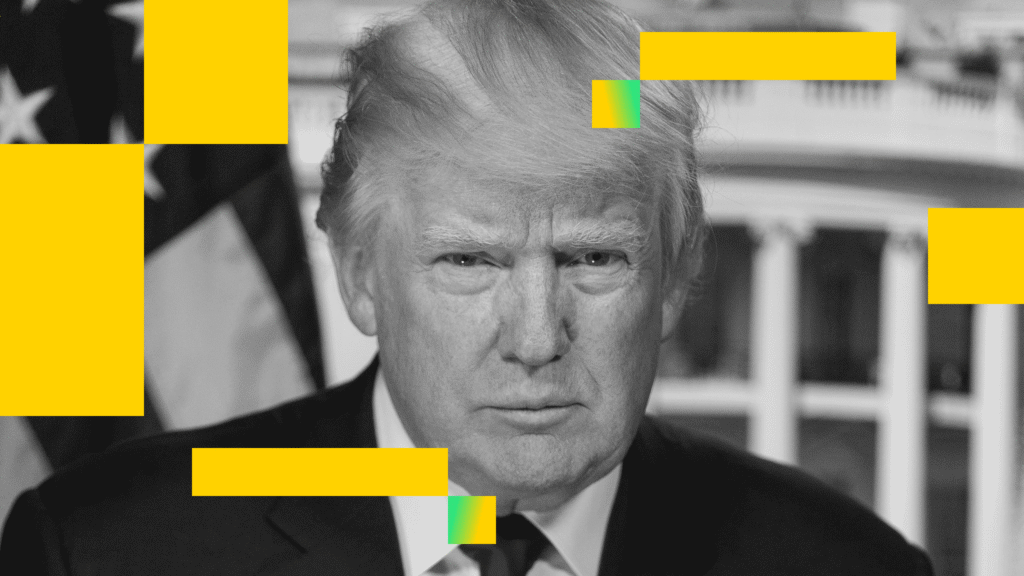

One of the most controversial features of President Donald Trump’s second term is his relentless criticism of Federal Reserve (Fed) Chair Jerome Powell for maintaining elevated interest rates – a stance Trump argues is unnecessarily costly to the American economy.

But this is more than just rhetoric. Trump is aggressively attempting to undermine the Fed’s board, threatening an institution long known for its political independence. Ironically, this very assault risks backfiring, deepening what Trump and others describe as a Fed that is “behind the curve,” potentially leading to a deeper sell-off in the U.S. dollar.

“Political pressures make it tough to credibly shift to an overtly dovish footing. That leaves policy data driven (thus late) rather than pre-emptive. That’s bad for the USD,” the market insights team at Lloyds Bank led by Nicholas Kennedy, said in a note to clients on Sept. 18.

Trump’s Attack on the Fed

Last Thursday marked a new chapter in Trump’s campaign against the central bank, as his administration took the unprecedented step of petitioning the U.S. Supreme Court to allow the firing of Federal Reserve Governor Lisa Cook. This would be the first forced removal of a sitting Fed governor since the institution’s founding in 1913.

The move followed a temporary judicial block issued by U.S. District Judge Jia Cobb, who prevented the ousting of Cook, a Biden appointee, pending further legal proceedings.

According to the Lloyds Bank market insights team, such attacks are likely to increase as Powell enters the final months of his term as Chairman. Trump’s recent appointee at the Fed, Stephen Miran, is already calling for rapid-fire rate cuts and wants the bank to reduce the benchmark borrowing cost by 50 basis points in the recently concluded meeting.

Behind the Curve

At its core, Trump’s campaign reflects a desire for a Fed more responsive to his economic worldview, which demands ultra-low rates around 1%, down significantly from the present 4%.

Trump has argued that current rates keep mortgage costs prohibitively high for many Americans, hindering homeownership and imposing billions in unnecessary debt refinancing expenses. He frames this as a staggering missed opportunity on an otherwise “phenomenal” economy. Meanwhile, many economists agree that rates remain too high given signs of weakening labor markets and consumer health.

Thus, the Federal Reserve is widely perceived as “behind the curve” – a technical term meaning it is too slow to cut rates in response to evolving economic conditions.

Yet, Trump’s insistence on forcing faster rate cuts risks pushing the Fed further behind this curve.

Damned if they do, damned if they don’t

Imagine holding the reins of the world’s most powerful central bank, responsible not only for the world’s largest economy, but the fate of the global reserve currency, the USD. Now imagine the political pressure to cut rates quickly, against the fear of appearing politically compromised. This leaves policymakers damned if they act and damned if they don’t.

So, unlike typical policymakers who adjust with measured calm in response to data, Powell and his colleagues now operate under intense political pressure and public scrutiny from the White House. They face a classic catch-22: face accusations of succumbing to political pressure in case of rapid rate cuts (even if they do so independently); wait too long and risk the potential deepening of an economic slowdown.

This dynamic could breed reflexive stubbornness. To avoid accusations of capitulating to political pressure, the Fed may instinctively lean towards caution – waiting longer and keeping rates elevated. However, this posture can exacerbate the problem: delayed rate cuts keep monetary policy out of sync with economic conditions, much like a patient who resists mild medication only to require drastic doses once a fever spikes.

The subsequent high doses of rate cuts could be interpreted by markets as a sign of panic, leading to increased volatility in financial markets, including cryptocurrencies.

Dollar at risk

The catch-22 situation could also weigh on the U.S. dollar, a bullish development for dollar-denominated assets like gold and bitcoin.

The dollar index, which measures the greenback’s value against major currencies, has dropped nearly 10% this year to 97.64. Meanwhile, bitcoin’s price has rallied by 24% to $115,600.